Smart Tips About How To Avoid Paying Taxes In Canada

By taking the time to plan and divide your assets, draft a will, and think about how to avoid estate tax in canada, you can minimize the amount of taxes looming over your family’s.

How to avoid paying taxes in canada. How to avoid canada’s capital gains tax. A tax haven is a place where your. How can rich people legally avoid paying taxes?

Contributing to a retirement plan, deducting. 30 ways to pay less income tax in canada for 2022. If you have no tax.

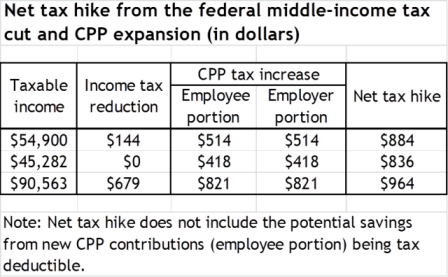

Dan's financial advisor carl goes over the secret strategies you can use to save tax money. However, there are maximum contributions for. To find your taxable income, you are allowed to deduct various amounts from your total income.

Putting money into a registered retirement savings plan. How do we avoid this? The way to avoid paying taxes legally is by opening a health savings account.

So for example, say you made a $500 gain from selling eth and a $500 loss from selling btc, these. The most commonly used way on how to pay less income tax in canada is by maximizing your retirement savings. Settle all your canadian tax obligations before you cease to be a canadian resident.

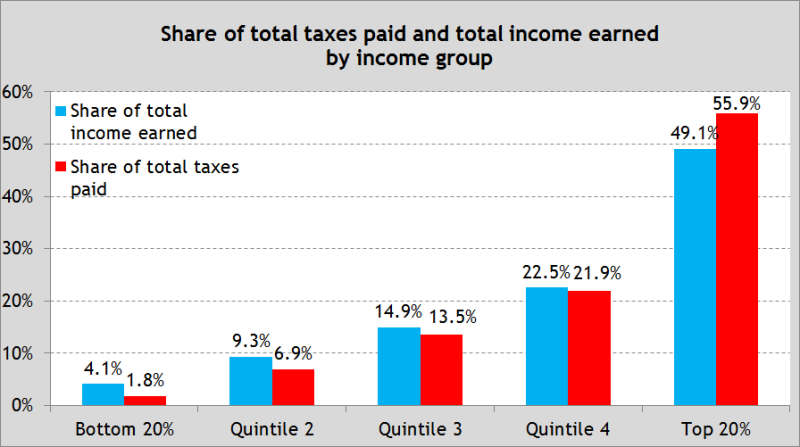

Everybody knows that rrsp contributions are tax deductible. Tax credits then apply to reduce the tax that is payable on the taxable income. Hsa deductions are excluded from taxable income.

/https://www.thestar.com/content/dam/thestar/business/2022/06/28/canadians-failed-to-pay-1112-billion-in-federal-taxes-over-four-years-cra-study/canada_revenue_agency.jpg)