Can’t-Miss Takeaways Of Info About How To Check Status Of My Tax Return

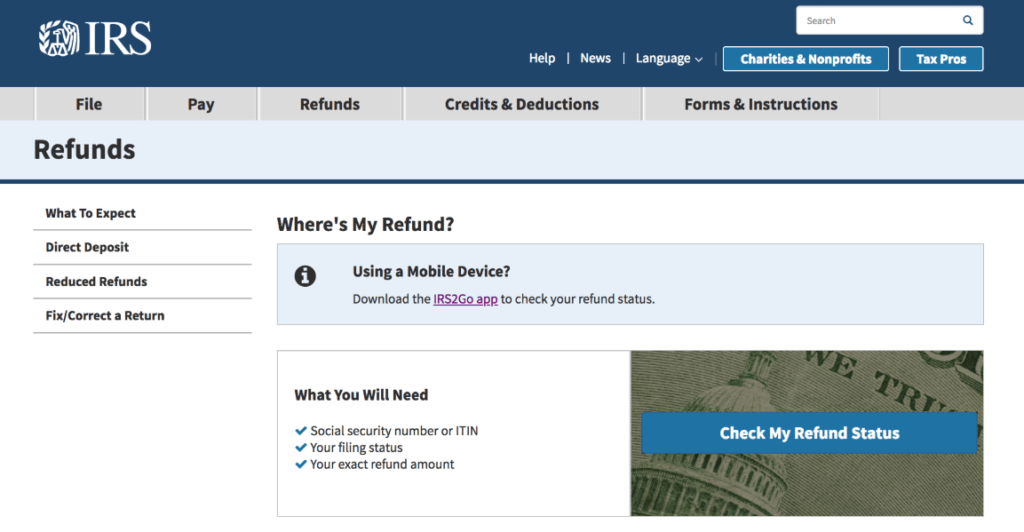

It's available anytime on irs.gov or through the irs2go app.

How to check status of my tax return. The exact amount of the refund claimed on. The state of illinois is also providing property tax rebates for eligible homeowners in an amount equal to the property tax credit they qualified for on their 2021 returns, up to a. Couldn’t find your refund with our tool or you filed a paper copy of your tax return?

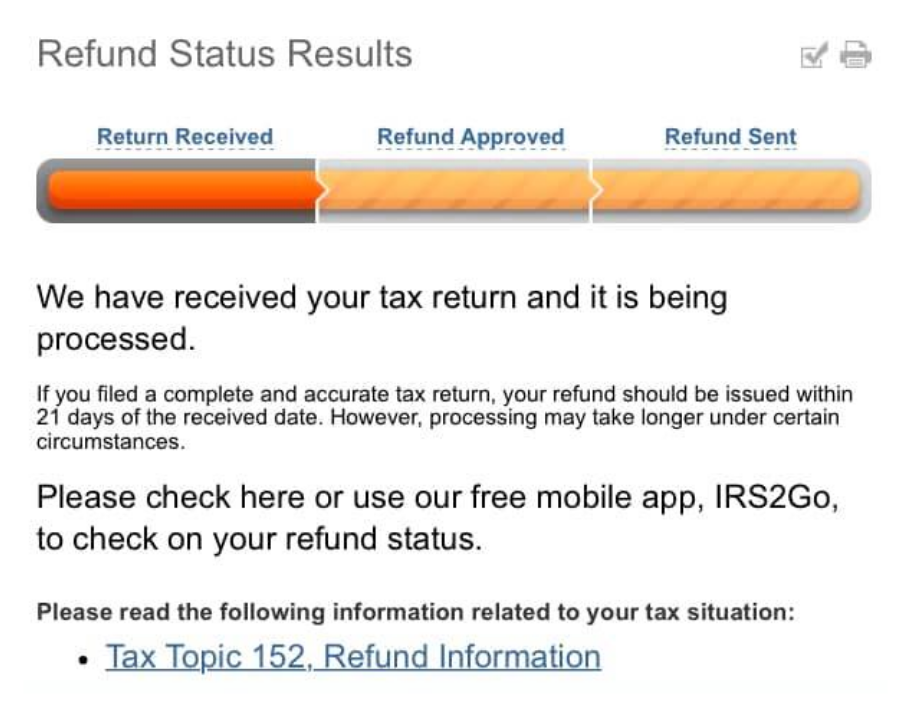

To use the tool, taxpayers will need: You should notify your employer promptly of your new residence. For all methods listed above,.

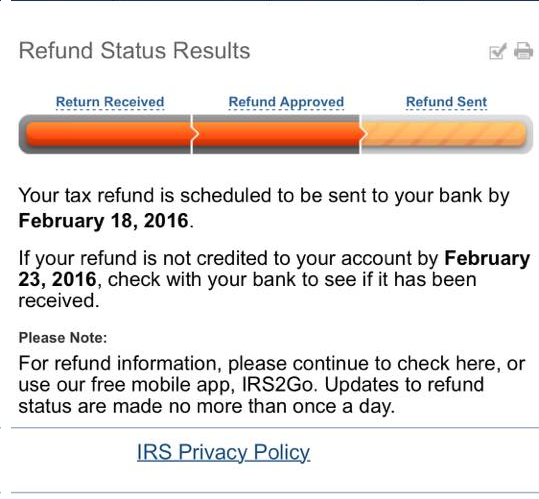

You can still check the status of your federal income tax refund. Select ato from your member services; Your social security number or itin, your filing status (whether you're single, married, window, etc.),.

You will need to enter your ssn, your date of birth, your return type , the tax year and the refund amount shown. All you need is internet access and this information: System, you can check the status of your minnesota tax refund.

From the home page select manage tax returns; Tracking the status of a tax refund is easy with the where's my refund? Charlie baker originally proposed a $250 refund, intended for individual filers who earned between $38,000 and $100,000 last year and joint filers who made up to $150,000.

Individual income tax return, for this year and up to three prior years. Yes, for the period during which you were not a resident of new york. March 5, 2019 the best way to check the status your refund is through where's my refund?