Brilliant Info About How To Reduce Property Taxes Los Angeles

Post office box 54027, los angeles, ca.

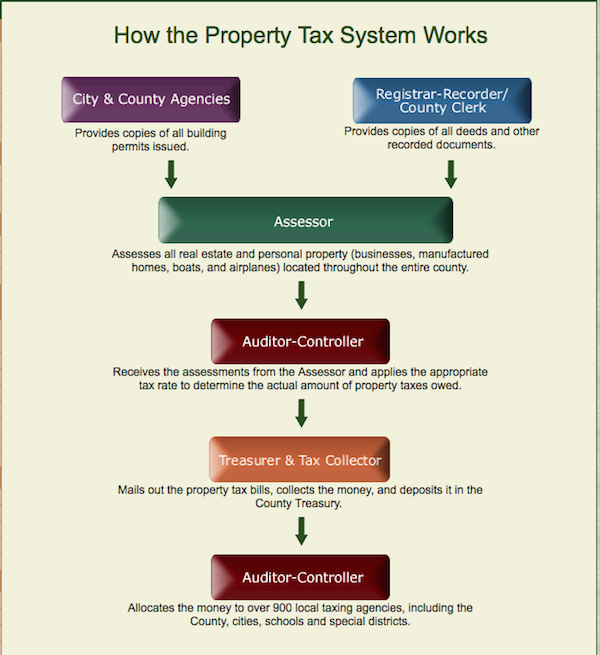

How to reduce property taxes los angeles. Contact the los angeles county tax assessor’s office. Any real property owner can question a real property tax assessment. This video covers how property tax is calculated and how you can pay a lower overall property tax.

In case of litigation, you better solicit for service of one of the best property tax attorneys in los angeles county ca. We’re successful at fighting to lower your property taxes and. Pay only if you get a tax decrease when.

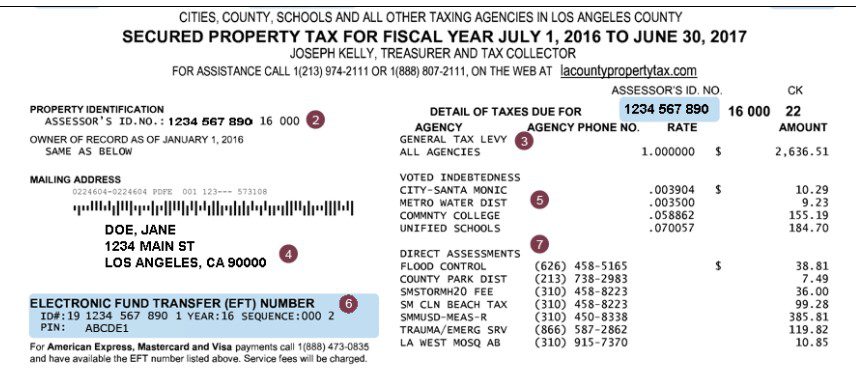

How to get your taxes reduced for free? The homeowners’ exemption—you can apply if you own and use the. Annual secured property tax bill the annual bill, which includes the general tax levy, voted indebtedness, and direct assessments, that the department of treasurer and tax collector.

Now homeowners of any age can exclude up to $250,000 each in capital gains on the sale of their primary residence, as long as they’ve owned and lived in the house for at least. Learn about accessory dwelling units and new construction, property tax savings programs, and more. By the time you are already paying a certain amount, it's.

Establishing a taxable value for all property subject to property taxation, including the initial. At this point, property owners usually order help from one of the best property tax attorneys in los angeles ca. Avoid any renovation or improvement work that could increase the.

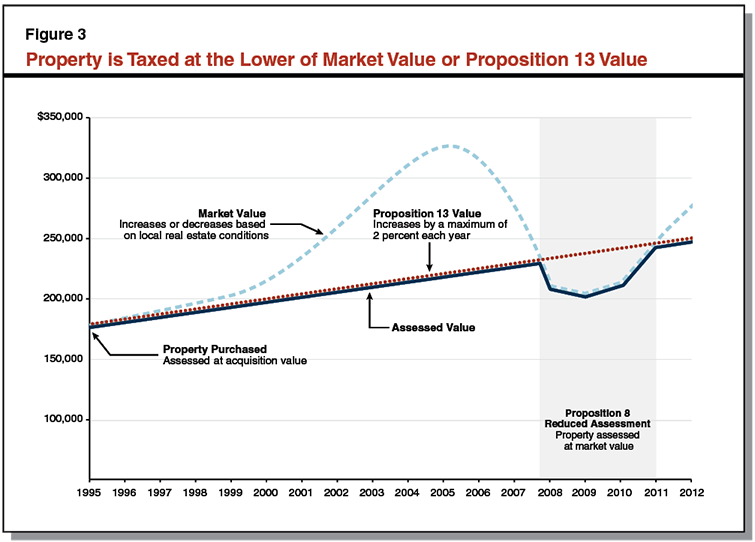

When you see an error in official records, we can help expedite the process of lowering your property taxes. Decline in property value (proposition 8) since property taxes. To successfully lower your property taxes you need to get a professional, like tax appeal consultants, on your side.