Supreme Tips About How To Start Foundation

Obtain 501 (c) (3) tax.

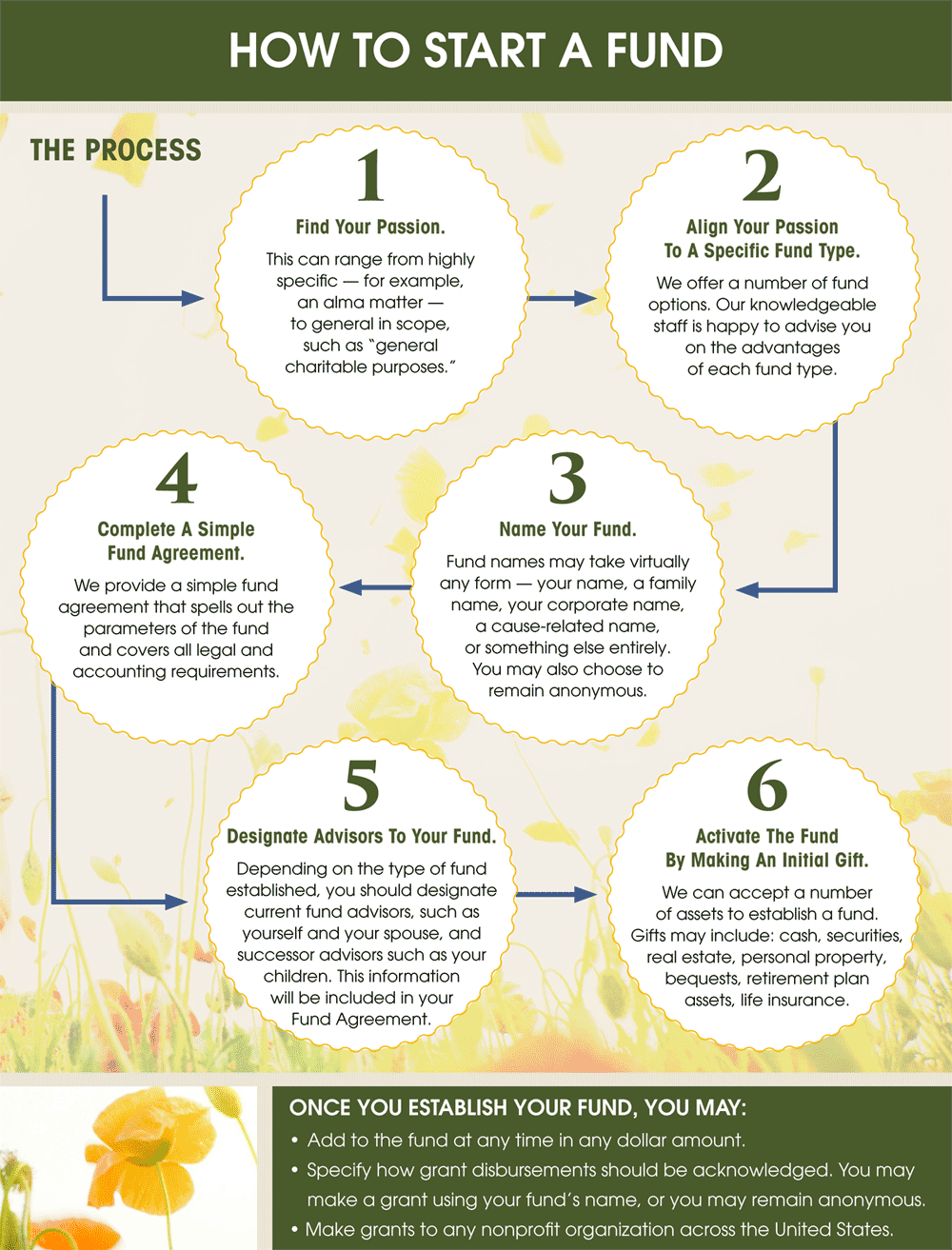

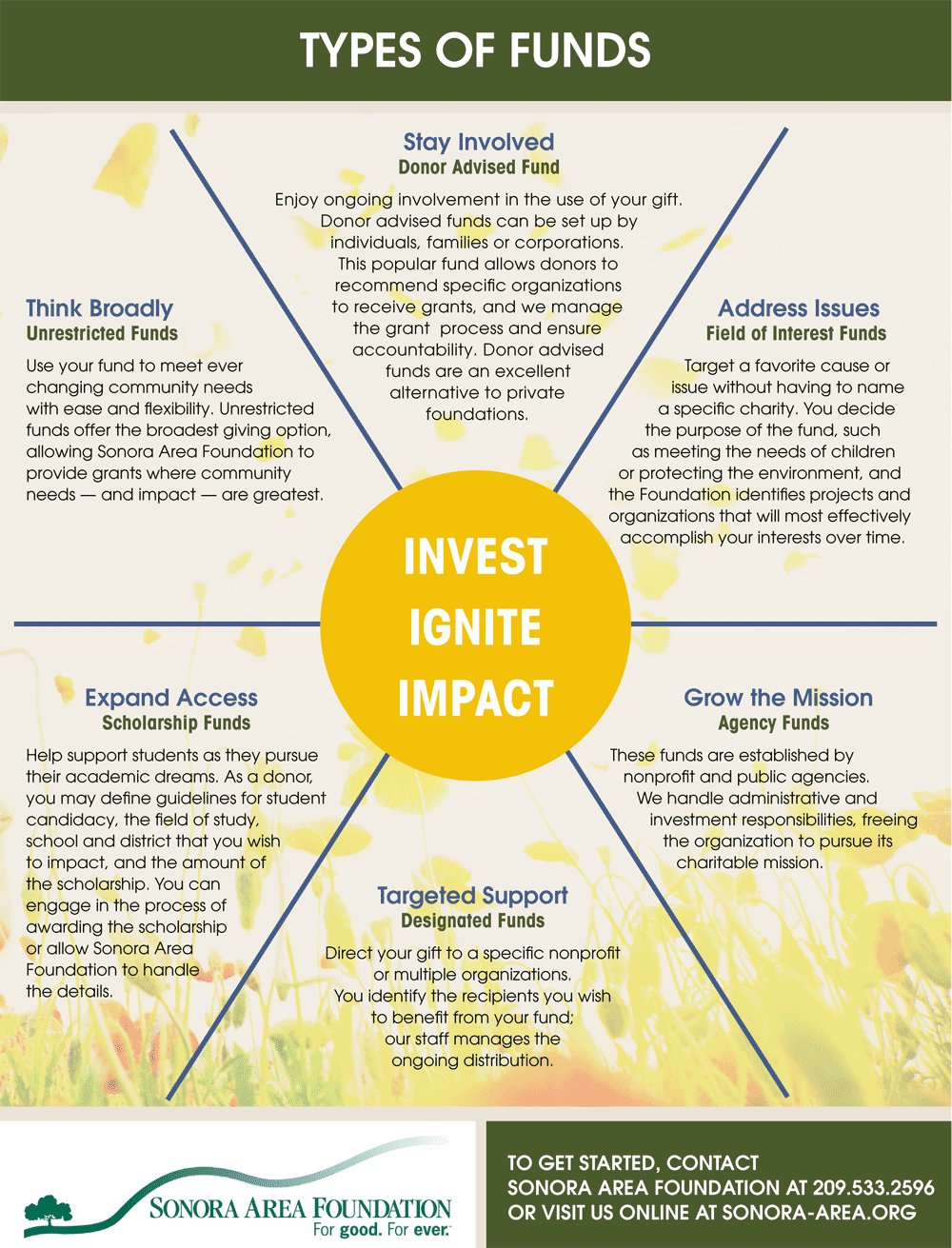

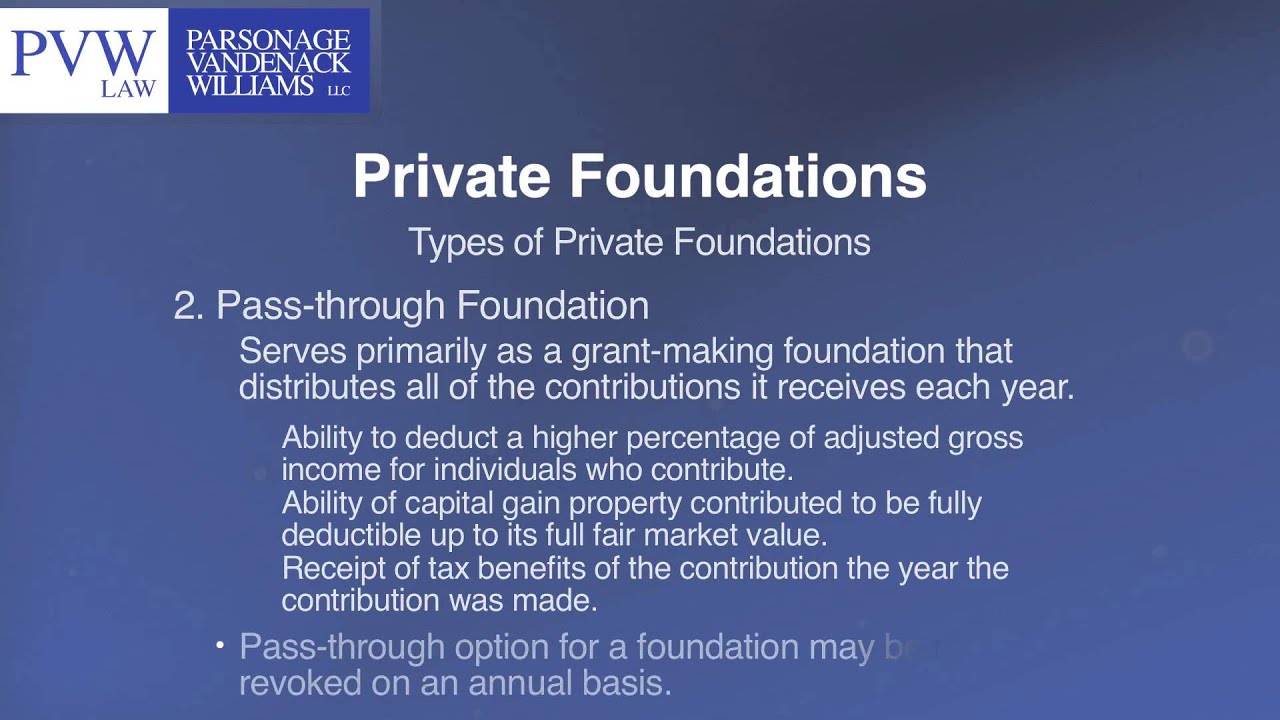

How to start foundation. You have to define your purpose, apply for the status of tax exemption, earn permits and licenses; Hire an experienced accountant and attorney. When starting a foundation, it is essential for the donor or the donor's advisor to comprehend—at the outset—the basic legal rules that govern the formation.

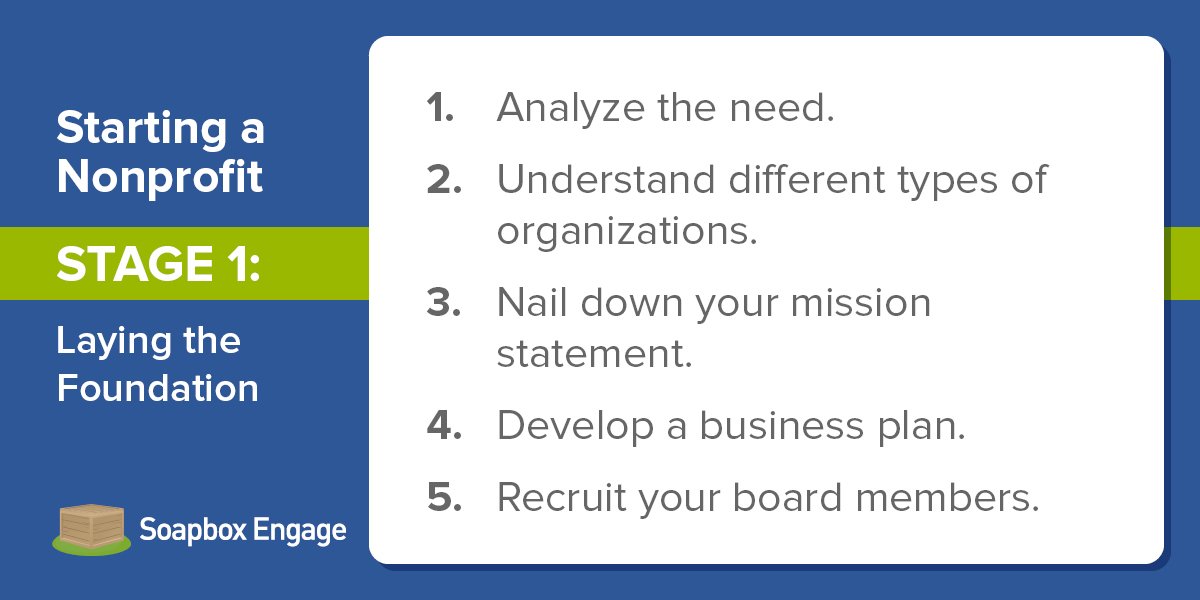

Create a board of directors. First of all, you need to decide whether or not you want to hire an attorney for the legal process or do it all. A good mission statement helps you build a solid foundation upon which you can create a plan and is your guiding light attracting the right people to your organization.

We make the registration process easy and reliable. Develop bylaws and a mission statement. We can also help you operate your foundation with our optional ra and compliance services.

Our ultimate vision is to create unlimited. How to start a foundation for your organization. A good way to do this when starting a foundation is to identify and track your top key performance indicators (kpis).

How to start a foundation, step by step. Elect a board of directors and officers. File for the state tax documentation.

Obtain an ein via irs form ss4. Going into business for oneself or starting a foundation are nearly synonymous at their inception. Key steps to start a charity or foundation:

:max_bytes(150000):strip_icc()/enthusiastic-community-posing-with-large-donation-check-944815842-39381ffef936408d80627e1c9ebf15a3.jpg)